So… What is a dollar?

You probably have an idea of what $1.00 is in your head. Depending on who you are, it might look like a four quarters, a green bill with the number 1 on it, a check, a number in a bank account, a number in your Venmo/CashApp, or maybe even credit on your Amazon account.

In this blog, we’ll be breaking down the “money” ness of it all, but first we need the “definition of money” and that is, according to wikipedia:

- Medium of exchange – How does it settle?

- Store of value – How is it held?

- Unit of account

TLDR on 3: Just like how we use gallons and meters, most people, Americans at least, denominate using the unit, dollar. The representation of that 1 unit, dollar, has already been illustrated and highlighted.

Cash

You’re familiar with it, GW is staring you dead straight in the face.

Let’s breakdown how a transaction works, pretend you’re at 7ELEVEN buying a snickers bar:

Medium of exchange: When we “use” cash, once that bill hits the register and a snickers bar is in our hand the transaction is settled and done (pretty fast, we’ll even call it instantaneous). But as the world becomes more digital, cash is also becoming less frequently used/accepted. Can’t reload your toiletries from amazon with cash.

Store of value: For small amounts, you likely hold it in a wallet to “protect” it. The bills themselves are also prone to ripping/damages/counterfeiting, and more concerningly, you are physically in charge of securing the holdings. Lost your wallet? Too bad! Want to hold onto $1000+? If you’re anything like me, you’ll get the boo-boo jeebies. Why? Again, its the personal accountability.

So what’s the problem? Its not always accepted and its hard to hold a lot of it at once. Let’s move on.

Bank Accounts

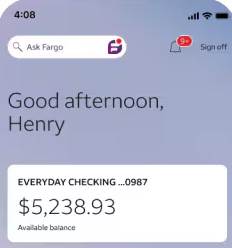

My guess is that this is probably where most people believe money is/stored.

I personally bank at Wells, you probably bank one of these titans like Chase or BofA as well.

Let’s once again break down a transaction:

Medium of exchange: When we “use” some sort of banking instrument it usually goes like this

- Checks: you SIGN a piece of paper to VERIFY “To whomever this check is issued to, you may take XXX dollars out of my checking account”. Time to settle depends when the checks are brought to the bank, generally good for up to 90 days(?!)

- Debit cards: Essentially paperless checks, verifying via a PIN number instead. As payment, Whoever accepts it needs some sort of card terminal IRL. Also takes a few days to fully settle in the respective bank accounts.

- ACH: This is how direct deposit works, generally restricted to moving money from one US bank to another, may also take a few business days. Not particularly good for payments (if at all)

- Wire: This is a global standard of how to send money from one bank to another globally, they take absolutely forever and charge a lot to send.

So in general, these are a trade off for convenience (compared to physical cash) at the cost of settlement time. Important to consider, during that settlement time, overdrafts, fraud, etc. may occur.

Store of value: Fantastic, don’t need to go over much. Just remember your username & password or walk into a branch with your ID to have a chat with them about what you want to do with your money. Bear in mind, it is important to understand what the terms are; the bank OWES YOU dollars. You hold IOUs for dollars, not dollars themselves. If the bank goes bust, you are insured for whatever amount FDIC says, and for most people that’s perfectly fine. Again the tradeoff for convenience is generally worth it. Besides the risk of bankruptcy, the only risk I would be concerned about is seizure/freeze of assets, for whatever reason it may be, losing access to these IOUs can get very dicey very fast.

Bank-adjacents

This is where 2000-2020 resides.

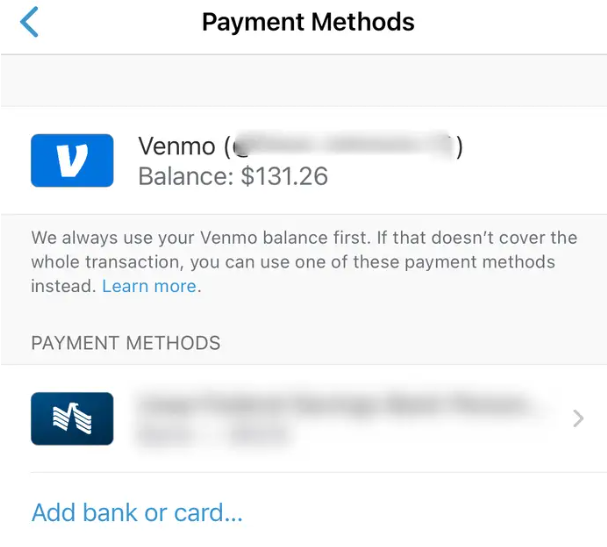

Many millenials, including myself, have signed up for all sorts of banking “wrappers” like Venmo, PayPal or CashApp.

Medium of exchange: These companies made it much easier to send money from “person” to “person”, via email/cell phone number/social media integration. They took the idea of banking services and streamlined it with a social component. “Idk my friends account number but I do know their phone number, how do I send the money?” Behind the scenes, its just a lot of debit-card/ACH transfers on our behalf because the user experience was better than using the banks directly. So it settles just as fast as the banks too.

The biggest caveat is as payment rails, they are not always available everywhere. Have you ever bought a snickers bar with Venmo?

Store of value: I don’t know a single person or business that dares to hold most of the money at one of these entities, enough said. If you do, please contact me.

Assets

This is probably where you’re min/max-ing the medium of exchange/store of value narrative. This is where you preserve purchasing power, where dollars turn into more dollars.

Medium of exchange: Nonexistent. You’re generally wrapping up dollars into a promise for more, these instruments can’t “buy” you anything: - certificates of deposit/government bonds: redeemable for x% interest on a y-period of time lock up, you hold an IOU for how much you wrapped up and then some more on top - high yield savings: still earning some x% but can be fluid between bank accounts without time lock up - money market funds: generally higher yields but “riskier” technically as now you’re foregoing the insurance aspect as well if it depegs - equities: ahh the exotic stuff, your share of apple or micrsoft has a different price every minute of every business day from 9:30am-4pm. Fantastic as a trade for more dollars in the future, bad trade for that snickers bar. Store of value: It’s the whole point, I don’t think I need to say more.

Wow are you done yet? Get to the point

This is the part where I introduce the concept of stablecoins. Stablecoins are the perfect hybrid of banking-level and banking-adjacent convenience for store of value with the instant settlement times of cash, with an emerging marketplace for yields, i.e assets you can buy using them. The sheer size of this technology cannot be understated.

Medium of exchange: Just like how you hold cash with a wallet, you hold stablecoins with a digital wallet. Just like how you went from writing physical letters to sending emails, you will go from handing over cash to sending stablecoins. And just like how when you hand over cash, its settled, when you send stables, its just settled with no bank involved! No check, ach, venmo, paypal. Your digital wallet has an address, it can simply send and receive instantaneously. Why is that important? Because the banks are too slow! Do you ever wonder why it is you get paid every 2 weeks? Maybe for some of you once a month? Few decades ago, it was a lot of work to cut checks frequently and pretty prone to error. We don’t live in the 70s anymore, you work hard every day, you could and should be getting paid by the hour/daily, certainly at least weekly. The technology to redistribute these dollars (which are mostly digital now anyway) instantly is here NOW. Do you eat at a restaurant and pay for their service 2 weeks later? No.

Store of value: The nuclear arms race that is stablecoin adoption is only starting to heat up! US Treasury Secretary Scott Bessent believes this is a multi-trillion dollar surface. I can’t fathom what $1T is but I know companies are racing to create stablecoins, and other companies racing to pass as much yield off stablecoins to get adoption. And the answer is clear, its just a better way to send/receive/hold money. Circle Internet Group, the creators of USDC, buys short term treasury bills and passes a lot of that interest back over to Coinbase and Robinhood, so that you can earn 4.5% without needing to go to treasurydirect.gov. I can assure you, Wells/Chase/BofA stopped doing this for you a long time ago and that’s just something as basic a US T-bills. If you want to get exotic, there are new apps out there like Aave that have varying rates of up to 10% on a given day peer to peer lending on certain stablecoins. If you ever needed to borrow money in a moments notice, you can do that now too. I’m not here to provide any financial advice on what to do, your risk profile is your risk profile, but it’s important to keep track of the progress made in this space.

What else?

As I said, the sheer size of this technology cannot be understated. We are talking about a complete reimagining of how money as we know it right now works. As Americans, we may take access to dollars for granted but for someone else with volatile home currency, access to dollars is limited via cash/banks and even preserving purchasing power could be hard, now its certainly easier. When Robinhood began popularizing 24/7 trading of certain stocks, it was because they were able to settle the trades using stablecoins. The deployment of Starlink in developing countries with all sorts of local payment markets was streamlined with stablecoins. Getting access to an overcollateralized loan 24/7/365 without a credit score is available now. Swapping excess airline miles for stablecoins will likely have some sort of marketplace one day too. I’m excited for what will be built and hope to provide a service of education and research as the space evolves.